An endowment is a permanent fund in which your donation (the “principal”) is invested, allowing it to grow over time to ensure that future generations will benefit from gifts made today. Your fund is managed as part of the larger Rensselaer Endowment, which represents a collective portfolio made up of hundreds of individual funds established by donors, as well as university funds.

The Rensselaer Endowment holds a diversified portfolio of assets, with dedicated allocations to a variety of investment segments including global public equity, fixed income, private equity, hedge funds, and real estate assets. The Rensselaer Board of Trustees, in fulfilling its oversight responsibility, utilizes an investment advisory firm to guide the investment strategy and asset allocations. This strategy aims to position the Rensselaer Endowment to achieve above-market returns with a desirable risk-return profile.

The endowment plays a critical role in the financial health of Rensselaer Polytechnic Institute. By generating sustainable income for key priorities such as scholarships, faculty support, and programs, the endowment enables RPI to maintain and plan for growth long into the future.

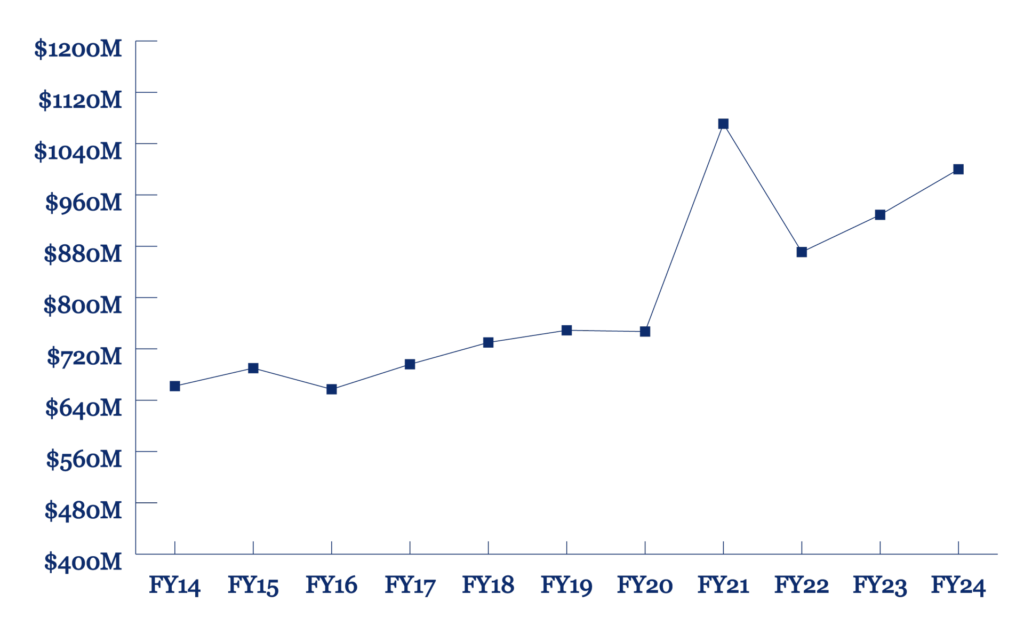

Endowment net assets

endowment value history